About the local option sales tax...

July 21, 2022

Talk and debate has spread across our community as of late, concerning whether or not to increase our local option sales tax from 2.5 percent to 2.75 percent in order to help with the building of a new high school.

What is the local option sales tax?

A local option sales tax is typically used as a means to raise funds for a number of local projects, especially for rural counties who receive less funding, and Lewis County would be no different.

Currently, Tennessee's sales tax is 7 percent and Lewis County/Hohenwald's sales tax is at 2.5 percent. According to Sales Tax Handbook, 65 out of Tennessee's 95 counties have opted for a local option sales tax of 2.75 percent. Out of our neighboring counties, Perry County is the only county who has not yet opted for the tax increase.

The .25 percent would be split in half between the school system and local government. After the school gets half, then the city and county governments divide the remainder based on where the sales tax revenue is generated.

Why is the increase needed?

There are several answers to just this one question. The largest reason seems obvious, but runs deeper than most realize.

Over the span of nearly two decades, Lewis County Schools and former Director of Schools, Benny Pace, had been able to save $12 million of the money needed to build a new school. At the time, the construction company quoted the school a total cost of $29,387,544 for the project, which meant the school would need to borrow $19 million.

In a past interview with Mr. Pace in April, he said they saved the $12 million by continuing to budget bonds that had already been paid off. Mr. Pace stated they requested that the local option sales tax be put on the ballot so that the "whole burden would not be put on the school" to pay off the USDA loan of $19 million.

Now the construction company raised the total cost to an estimated $38 million.

If the .25 percent increase does pass, the city has indicated that they would be willing to allow the school to keep the new revenue in order to help make the bond payment for a new high school.

Why is a new high school needed?

One of the biggest reasons cited for building a new high school is the safety of the eighth grade kids and teachers currently in the rock building. The rock building was built in 1949 and is easily the most vulnerable. All classes are only accessible from an outside door, all classrooms have a wall of windows that would do little to prevent an intruder and it is also the most accessible from a public road.

Apart from safety, the rock building continues to be the biggest issue of the middle school with it being in the worst shape of all the buildings. It is difficult to heat and air, and is the most difficult to maintain, according to a note written for the commission by Mr. Pace.

Once the new high school is built, the middle school kids would be moved to the current high school building.

Another reason is to have capacity for growth. Our current high school has the capacity for about 500 students, which is close to the current enrollment. The note stated that before the Saturn plant shut down, LCHS's enrollment grew to 620 students and we were facing critical overcrowding issues to the point it was affecting the quality of the kids' education.

In the same vein, classrooms have been limited for Career Technical and regular classes. When the school system was at their peak enrollment, several teachers had no set classroom and had to rotate to other teachers' classrooms during their planning time.

The commons area also has limited space. All students cannot gather in the commons area because the capacity is about 400.

When the middle schoolers move out to the current high school, they would have room to grow for years to come, and it would also allow grades Pre-K through fifth to expand into the current middle school. This would give the Intermediate School access to the current Middle School gym as they currently do not have access to any gym for inclement weather.

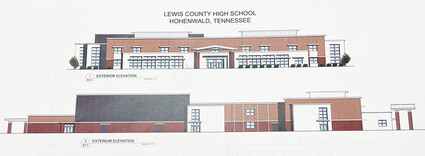

The new high school building will be built with growth in mind. During our past interviews, Mr. Pace stated that the architecture of the new building was created with the idea of being able to add onto the school as needed. This is a much needed design as Hohenwald/Lewis County natives can all attest to the fast growth of Lewis County in recent years. With programs like Nashville's Big Back Yard and those who are a part of the current urban exodus, Lewis County can surely count on more growth heading our way.

How the sales tax would affect your wallet

When the idea for a new high school was brought up in 2002, the original plan was to increase property taxes. But when reviewed later on, it was decided that the local option sales tax would put the smallest burden possible on Lewis County taxpayers.

A single item purchase is capped at the first $1,600 with the local option sales tax which would be an additional $4 to the current sales tax.

If you are not purchasing something as expensive, you may not even notice the increase. Here are some examples of how much the local option sales tax would add to your total:

• A $10 purchase will cost an extra $0.03

• $50 will cost an extra $0.13

• $100 will cost an extra $0.25

• $150 will cost an extra $0.38

• $200 will cost an extra $0.50

• $300 will cost an extra $0.75

• $400 will cost an extra $1.00

Reader Comments(0)